40% of U.S. consumers are willing to pay for remote health monitoring devices and services that would send their medical data to doctors, according to PricewaterhouseCoopers’ Healthcare Unwired (PwC). 51% of consumers would not buy mobile health technology.

40% of U.S. consumers are willing to pay for remote health monitoring devices and services that would send their medical data to doctors, according to PricewaterhouseCoopers’ Healthcare Unwired (PwC). 51% of consumers would not buy mobile health technology.

The uses of mobile health most attractive to consumers are monitoring fitness and welling (cited by 20% of consumers), physician monitoring of health conditions (for 18% of people), and monitoring a previous condition (for 11%).

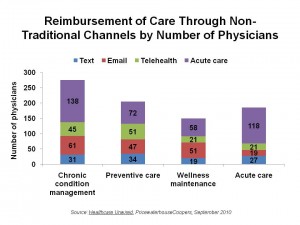

88% of physicians would like to see patients monitoring various parameters at home, their highest priorities being weight (65%), blood sugar (61%), vital signs like blood pressure (57%), exercise (54%), calories (36%), pain (36%), and sleep patterns (35%).

Those people most attracted to mobile health technology include men more than women, people who have individual health insurance policies (vs. group health/employer-based), and more healthy people.

PwC’s Healthcare Research Institute (HRI) gauges the remote/mobile monitoring device market range value from $7.7 billion to $43 billion, based on the prices people would be willing to pay.

PwC’s report is sub-titled, “New business models delivering care anywhere.” PwC sees 3 business models for so-called “unwired health:”

- Operational/clinical, enabling providers, payers, employers, suppliers and new entrants to do transactions and provide services for customers more efficiently. Here, think about workflow for physicians and online visits with patients, for example.

- Consumer products and services, which enable people to “know their numbers” and share their personal metrics with others. This business model could focus on medication and therapy compliance/adherence. Mobile phones for health apps fit into this business model.

- Infrastructure, which is the pipeline and enabling platform for connecting health information. This category includes bandwidth, integration, and security.

Consumers note the preferred supply channel for buying mobile health products are hospitals and health systems.

PwC surveyed 2,000 consumers and 1,000 physicians in the U.S. during the summer of 2010 for this study.

Health Populi’s Hot Points: PwC’s poll is the first to measure health citizens’ communications preferences along several dimensions. For example, text messages are more likely to be used by people covered by Medicaid, Tricare (active armed services health plan), employee-sponsored, and those with individual policies. Lower levels of texting are done by people with Medicare (43%) and Veteran’s health (45%) — but even these are fairly high numbers that could surprise industry analysts who don’t believe older people text.

The opportunity is clear here for Medicaid programs in the 50 states looking to manage population health: the ubiquity of mobile phones and use of text messaging among people enrolled in Medicaid is an opportunity to reach out and help people manage chronic conditions such as asthma and diabetes. There may even be a compelling argument for Medicaid and other payers to pay for phone access when people comply with treatment regimens, saving money in averted visits to the emergency department as one trackable outcome metric.

For the one-half of consumers not interested in paying for health monitoring, plans and payors need to think about the business model of paying for these services and devices are part of a more global approach to financing and managing on a population-health basis.

Another intriguing finding is that health consumers prefer buying mobile health technology from health providers. Here is the opportunity for trusted health systems to partner with trusted retail channels like Best Buy (already positioning itself as a med-tech retail channel), Walmart, Target and other retailers who have strong pharmacy and health product orientations.

Healthcare Unwired offers plenty of thinkertoys for re-imagining health and health care with the consumer/health citizen at the center of the health ecosystem.

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're